What is the Immigration Skills Charge?

The government has recently been accused of imposing a “stealth tax on the NHS” after it was revealed that NHS trusts paid out over £15 million in immigration fees since 2017, in order to fill specialist roles.

The NHS relies heavily on skilled workers from overseas to fill many specialist healthcare roles each year, and as a result trusts are required to pay the Immigration Skills Charge, a cost levied on UK organisations employing foreign workers for six months or more.

However, it is not only the NHS suffering costly immigration fees when hiring talent from overseas. Any UK business sponsoring migrant workers on a Tier 2 skilled worker visa are required to pay set immigration fees, which can quickly stack up.

Furthermore, the soaring costs associated with employing a migrant workforce are set to hit potentially hundreds more UK businesses when the UK implements its new points-based immigration system on 1 January 2021.

When the Brexit transition period comes to an end on 31 December 2020, Freedom of Movement from the European Union (EU) will end, and both EU and non-EU citizens will be treated equally under a new, single immigration system. This means employers will need to sponsor all EU, EEA and Swiss workers who do not hold settled status, and pay the associated immigration fees.

How much is the Immigration Skills Charge?

Sponsors are required to pay an Immigration Skills Charge for each Certificate of Sponsorship (CoS) they assign, unless an exemption applies. The amount charged will depend on the size of the organisation and the length of employment stated on the CoS.

Currently, the Immigration Skills Charge for small or charitable sponsors is £364 for the first year of employment, plus £182 for each subsequent six month period. Medium or large sponsors are required to pay the larger fee of £1,000 for the first year plus £500 for each additional six month period.

What other immigration fees are involved?

Employers who are not already approved by the Home Office to sponsor skilled migrants will need to apply for a sponsor licence and pay the relevant application fee. Currently, the application fee for a small or charitable organisation is £536, and a higher fee of £1,476 applies for medium or large sponsors.

As well as the Immigration Skills Charge, sponsors will need to pay a fee for every Certificate of Sponsorship they assign, which currently stands at £199 for a Tier 2 skilled worker.

Other costs to consider are the visa application fees and the Immigration Health Surcharge which migrants must pay in order to access free healthcare in the UK. From October 2020, the Immigration Health Surcharge is set to increase from £400 to £624 per person per year. These costs are usually covered by the migrant worker, however some employers opt to contribute towards immigration fees for their employees and occasionally their dependents too.

Case studies

Employers looking to hire skilled EU or non-EU workers from 2021 should be aware of the costs involved with sponsoring migrants, especially if the business previously relied on the free movement of workers from the EU.

The below examples break down the typical costs that employers can expect to pay when engaging staff under the skilled worker route.

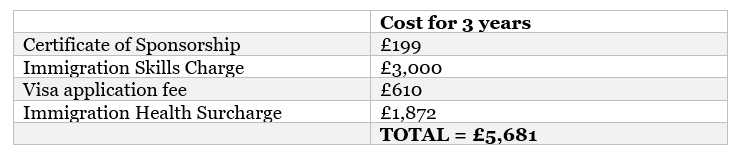

Example 1 (Single employee):

It’s January 2021, and a medium sized UK technology company wishes to hire a software engineer. The company is already approved as a Home Office sponsor, and has paid the £1,476 fee to obtain a four-year sponsor licence.

Following interviews, they offer the role to a French national. He meets all the requirements under the skilled worker route, and the company agrees to sponsor him for three years.

To sponsor the employee for the three year period, the employer can expect to pay a fee of £199 for issuing the CoS, alongside an Immigration Skills Charge of £1,000 for the first 12 months of employment, plus £500 for each additional six-month period stated on the CoS. This presents a total cost of £3,199 for the business.

According to the company’s internal policies, the employee is expected to cover his own visa application fee, plus the Immigration Health Surcharge for three years, totalling £2,482.

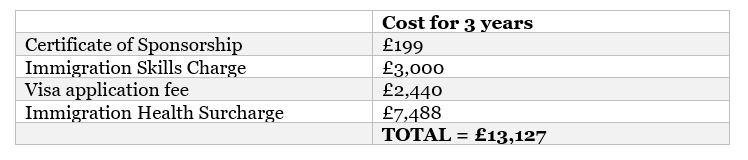

Example 2 (A family of four):

The same company is also hiring for an IT Security Manager. After a successful interview, the company offers the job to a German national. The fees for the business are the same, totalling £3,199 for the CoS issue fee and the Immigration Skills Charge combined.

However, in this case the employee also has a wife and two children who would be accompanying him to the UK as dependent applicants. This means the applicant will not only have to cover his own visa application fee and Immigration Health Surcharge for three years, but also the same fees for his three dependents. These costs quickly stack up, meaning the applicant will need to pay £9,928 to move his family to the UK.

Be Aware, Be Prepared

With the clock ticking down to January 2021, Smith Stone Walters would advise all businesses to use the remaining time to familiarise themselves with the upcoming changes to immigration rules and prepare accordingly.

Our team of expert immigration consultants are on hand to advise and support your business through the changes, helping you to focus on what matters most – your employees.

Contact us today to find out how we can help.